A donor advised fund (DAF) is a tax-efficient, flexible, and convenient way to support the ministries and causes you care about and establish a legacy of giving.

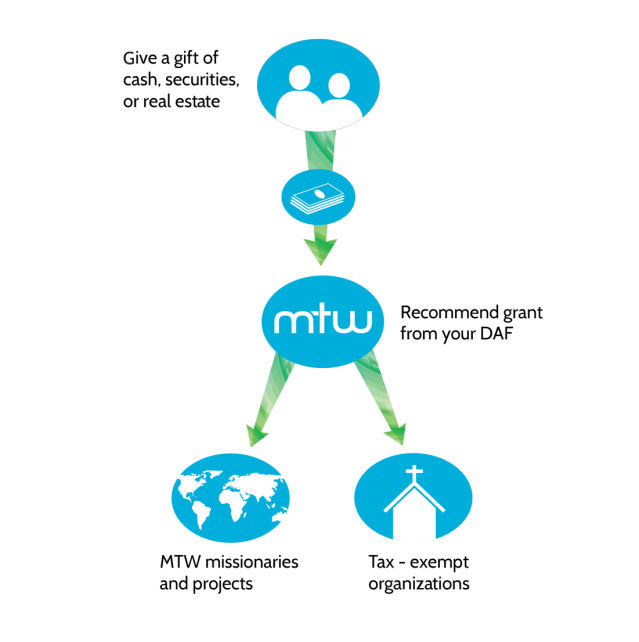

First, with the help of our gift planning specialists, you set up a giving fund with MTW. Next, you fund your DAF by making a charitable gift of cash, stock, mutual funds, or even real estate, for which you receive immediate tax benefits.

Once the DAF is funded, you recommend grants from the fund to MTW missionaries, projects, your church, or other tax-exempt organizations. You have the convenience of having all of your donations in one place, but retain the flexibility to advise grants wherever you wish. We handle the details and send you regular reports, so you can focus on what really matters.

A donor advised fund (DAF) is a tax-efficient, flexible, and convenient way to support the ministries and causes you care about and establish a legacy of giving.

First, with the help of our gift planning specialists, you set up a giving fund with MTW. Next, you fund your DAF by making a charitable gift of cash, stock, mutual funds, or even real estate, for which you receive immediate tax benefits.

Once the DAF is funded, you recommend grants from the fund to MTW missionaries, projects, your church, or other tax-exempt organizations. You have the convenience of having all of your donations in one place, but retain the flexibility to advise grants wherever you wish. We handle the details and send you regular reports, so you can focus on what really matters.

Kingdom Impact

Make an impact for the kingdom, even after you are gone. You can use your DAF to support your church, missionaries, or ministries now, but you can also set up your fund so that it continues to give gifts from your estate after your death.

Legacy

Pass on a legacy of giving. You can involve your children in the decision-making process, teach them a philosophy of kingdom-centered stewardship, and name them as successor advisors—allowing them to take the reins and recommend distributions once you pass away.

Tax-Deduction

By transferring real estate into a DAF, you can receive a tax deduction based on the fair market value of the property and avoid capital gains taxes. The property will be sold, and this option allows you to choose where, when, and how to disperse proceeds of the sale to your church or other ministries.

Simpler Taxes

Make tax season simpler. With all of your charitable giving in one place, you only have to deal with one giving receipt at the end of the year.

Control

You are in the driver’s seat. You advise MTW on how and when to distribute gifts from your fund to whichever ministries or causes you care about.

How Does A Donor Advised Fund Work?

How Does A Donor Advised Fund Work?

Some Practical Examples

At the beginning of every year, Mrs. Utrecht funds her DAF with appreciated securities and distributes donations to several ministries throughout the year.

Mr. and Mrs. Westphalia are nearing retirement and have a high-income year. They use their DAF to help mitigate income tax and fund future giving in low-income years.

Mr. Oslo uses his DAF by donating real estate to benefit multiple ministries from one easy, central fund.

After their deaths, proceeds from Mr. and Mrs. Westphalia’s DAF account will continue to support their missionaries, church, and other ministries.

Some Practical Examples

At the beginning of every year, Mrs. Utrecht funds her DAF with appreciated securities and distributes donations to several ministries throughout the year.

Mr. and Mrs. Westphalia are nearing retirement and have a high-income year. They use their DAF to help mitigate income tax and fund future giving in low-income years.

Mr. Oslo uses his DAF by donating real estate to benefit multiple ministries from one easy, central fund.

After their deaths, proceeds from Mr. and Mrs. Westphalia’s DAF account will continue to support their missionaries, church, and other ministries.

Apply for a Donor Advised Fund Today

or contact us to schedule a FREE personal and confidential review of your current estate plan from a stewardship perspective.

You can reach us at 678-823-0028 or [email protected]

Apply for a Donor Advised Fund Today

or contact us to schedule a FREE personal and confidential review of your current estate plan from a stewardship perspective.

You can reach us at 678-823-0028 or [email protected]

Featured Stories

Walking With Church Planters in West Africa: A Vision Trip That Led to Impact

The spirit of humility and sacrifice among the church planters and young men being trained really struck me. I knew I wanted to do more.

Making Disciples: Training Up the Next Generation of Spiritual Givers

Those of us with the spiritual gift of giving are also called to play our role in making disciples—disciples who have the gift of giving.

Cutting the Coal: One Man’s Lifelong Call to Missions

As a teacher, he supported over 30 missionaries. As a missionary, he served the unreached in the jungle. Now 97, his stewardship continues.

BACK TO ESTATE & GIFT PLANNING

This website is for informational purposes only and is not intended to be legal, tax, or financial advice. Please consult your legal and tax advisors to verify its applicability to your specific circumstances.

BACK TO ESTATE & GIFT PLANNING

This website is for informational purposes only and is not intended to be legal, tax, or financial advice. Please consult your legal and tax advisors to verify its applicability to your specific circumstances.