Charitable Remainder Trusts

Immediate tax advantages. Income for life. Global gospel impact.

If you have appreciated securities or real estate that you want to sell, but have been reluctant to do so because of capital gains tax implications, a charitable remainder trust may be right for you.

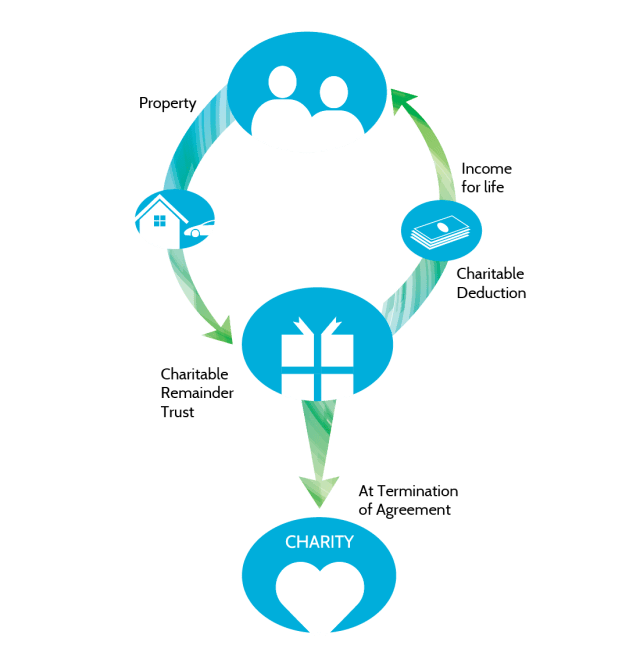

Our estate and gift planning specialists begin by working with you to assess your particular goals and needs. Next, real estate, cash, appreciated securities, or other assets are transferred into a charitable trust. Examples of assets we have worked with in the past include office buildings, rental houses, apartment buildings, and appreciated stock. The trust assets are then sold with no depletion of capital gains. The proceeds are invested in a balanced portfolio, managed by MTW and you receive immediate tax benefits and income from the trust for life. At the time of your death, the remainder of the trust assets go to MTW and your other ministries or church.

If you have appreciated securities or real estate that you want to sell, but have been reluctant to do so because of capital gains tax implications, a charitable remainder trust may be right for you.

Our estate and gift planning specialists begin by working with you to assess your particular goals and needs. Next, real estate, cash, appreciated securities, or other assets are transferred into a charitable trust. Examples of assets we have worked with in the past include office buildings, rental houses, apartment buildings, and appreciated stock. The trust assets are then sold with no depletion of capital gains. The proceeds are invested in a balanced portfolio, managed by MTW and you receive immediate tax benefits and income from the trust for life. At the time of your death, the remainder of the trust assets go to MTW and your other ministries or church.

Benefits Of A Charitable Reminder Trust

How Does A Charitable Remainder Trust Work?

How Does A Charitable Remainder Trust Work?

Case Study

Mr. and Mrs. Montague are in their early 70s. They care deeply about giving to their church and the missionaries they support, but also want to ensure financial security for their future. MTW’s Center for Estate and Gift Planning helped them create a charitable remainder trust, funded with a rental house valued at $250,000.

The Montagues received a charitable income tax deduction and avoided capital gain taxes on their property. MTW, as the trustee, invested the proceeds and provides Mr. and Mrs. Montague annual payments equal to 6 percent of the value of the trust’s assets for the remainder of their lives. They are financially secure and rest easy knowing that their church and missionaries will continue to be supported from their estate after they are gone.

Contact us to learn more about charitable remainder trusts, or to schedule a FREE personal and confidential review of your current estate plan from a stewardship perspective.

You can reach us at 678-823-0028 or [email protected]

Case Study

Mr. and Mrs. Montague are in their early 70s. They care deeply about giving to their church and the missionaries they support, but also want to ensure financial security for their future. MTW’s Center for Estate and Gift Planning helped them create a charitable remainder trust, funded with a rental house valued at $250,000.

The Montagues received a charitable income tax deduction and avoided capital gain taxes on their property. MTW, as the trustee, invested the proceeds and provides Mr. and Mrs. Montague annual payments equal to 6 percent of the value of the trust’s assets for the remainder of their lives. They are financially secure and rest easy knowing that their church and missionaries will continue to be supported from their estate after they are gone.

Contact us to learn more about charitable remainder trusts, or to schedule a FREE personal and confidential review of your current estate plan from a stewardship perspective.

You can reach us at 678-823-0028 or [email protected]

Featured Stories

Walking With Church Planters in West Africa: A Vision Trip That Led to Impact

The spirit of humility and sacrifice among the church planters and young men being trained really struck me. I knew I wanted to do more.

Making Disciples: Training Up the Next Generation of Spiritual Givers

Those of us with the spiritual gift of giving are also called to play our role in making disciples—disciples who have the gift of giving.

Cutting the Coal: One Man’s Lifelong Call to Missions

As a teacher, he supported over 30 missionaries. As a missionary, he served the unreached in the jungle. Now 97, his stewardship continues.

BACK TO ESTATE & GIFT PLANNING

This website is for informational purposes only and is not intended to be legal, tax, or financial advice. Please consult your legal and tax advisors to verify its applicability to your specific circumstances.

BACK TO ESTATE & GIFT PLANNING

This website is for informational purposes only and is not intended to be legal, tax, or financial advice. Please consult your legal and tax advisors to verify its applicability to your specific circumstances.